The 4-Minute Rule for Your Home And Garden

Some lending institutions need you to pay your home tax obligations as well as your house owners insurance policy as component of your mortgage repayment. Discover all the expense components that compose a typical home loan settlement, and use our to approximate your month-to-month home mortgage payment. You typically have to pay sales tax when you purchase something in a store.

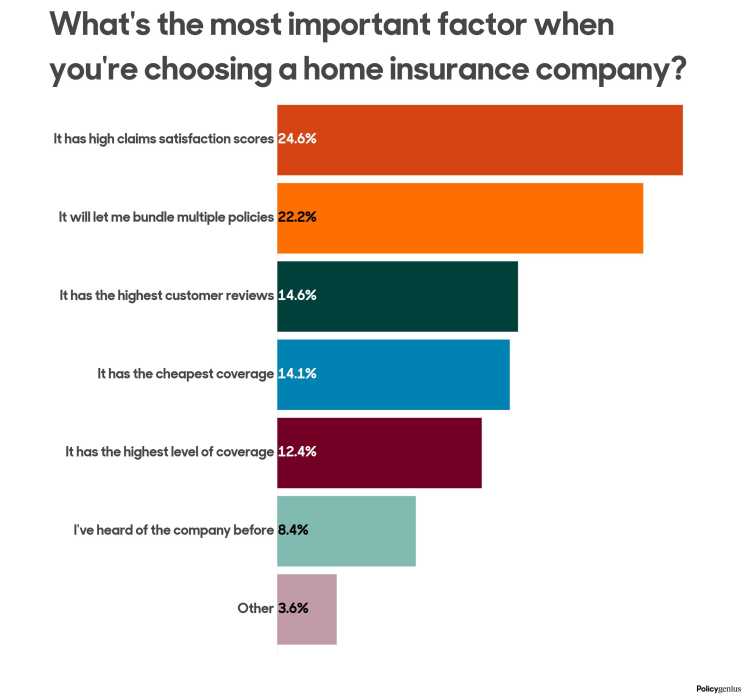

On many flights, you will not need to depend on it, but the one time you diminish your bike, it might save your life. Even if you think you don't require residence insurance policy, several mortgage lenders require you to have it. There are two main kinds of house owners insurance coverage: home and personal property insurance policy.

The cost changes based on your level of protection as well as place. However usually, homeowner's insurance coverage costs around $1,428 per year for a plan with $250,000 in home protection. When picking just how much protection to purchase, take into consideration exactly how much it would set you back to reconstruct your house rather of checking out exactly how much your home deserves.

What Does Your Home And Garden Do?

You can additionally take into consideration some prominent budget-friendly upgrades to potentially improve your residence's value (which can result in a greater sale cost ought to you make a decision to relocate). Maintenance charges differ commonly, whether you a home. Energies might not be top of mind when it comes to homeownership expenses, yet whether it's your electricity, water, a/c, warmth or Wi, Fi they are tough to live without and pricing can differ based upon your area and size of your home (even the age of you're A/C can impact your prices).

The last thing you want to bother with as a homeowner is insects invading your house. You might require to purchase specialist parasite control to maintain critters out of your area. You can anticipate to pay between $400 as well as $950 annual for basic, full-service pest control, but the expense can differ depending upon your circumstances.

Your home may have significant appliances, such as a range, oven, fridge as well as dishwashing machine. If your residence does not have any type of home appliances you can't live without, you'll need to start conserving for them. New devices can vary commonly depending upon the kind, version and also tier (ranging in average between $350 and $8,000), so be sure to account for any kind of missing appliances while you house hunt.

More About Your Home And Garden

Think about investing a long time living in the area to find out your exact demands in terms of storage space, company and style. Take supply of items you currently have that you prepare to bring right into your new house as well as begin conserving for those in the future. If you wish to equip your entire house, the typical cost is $16,000.

https://www.gaiaonline.com/profiles/urh0megarden/46383165/

You'll be a lot more prepared to take the leap once you pass the number crunching (and anticipating the unanticipated). Attempt utilizing a price of homeownership calculator to help you compute the real expenses. Keep in mind that you'll experience various prices if you intend to.

Advertisements by Cash. We may be compensated if you click this advertisement. Advertisement The real estate market has actually been kind to home owners these last few years. The typical house worth has actually leapt 43% since late 2019, as well as vendors have generated eye-popping revenues due to the fact that of it. Yet that was then. As we head in 2023, the market looks very different.

Your Home And Garden Things To Know Before You Buy

Residence sales have actually slowed 6% contrasted to last year, and review also costs have currently started to fall (at the very least month-to-month). "Many forecasts are currently asking for a decrease in home rates following year," says Kenon Chen, executive vice president of business technique at Clear Funding, a realty data and also innovation copyright.

For others, there may be some cost savings to be had. As Jessica Peters, a property broker with Douglas Elliman, puts it, "Costs will certainly trend downward, but that doesn't always mean doom and also grief." Which group do you fall under? Below's what reduced home worths would really imply for home owners and who need to (and also shouldn't) be worried.

"If you got your residence in 2008 or 2009, marketing in 2023 will still be profitable for you," states Maureen Mc, Dermut, a realty agent with Sotheby's International Real estate in Santa Barbara, The Golden State. "If you acquired in 2021 and intend to sell in 2023, then you may end up taking a loss.

About Your Home And Garden

We may be made up if you click this advertisement. Ad Declining residence values would also suggest less equity for property owners across the board. Home equity or the distinction between your residence's current worth as well as any home loan connected to it has increased over the last few years. The ordinary American home owner got $60,000 of it in the in 2015 alone.

The even more equity you have, the much more you stand to obtain when you sell. A lot more than this, equity is likewise an economic device.

If equity declines, however, property owners will certainly be able to borrow much less or perhaps not be qualified for these kinds of products in all. This can be big considering just how preferred HELOCs have become in recent months. In the initial half of 2022, HELOC borrowing reached its highest possible point in 15 years, leaping 30% compared to 2021.

How Your Home And Garden can Save You Time, Stress, and Money.

"If a property owner assumes they might need to use some of that equity, it's much better to obtain that HELOC in position now." Those that already have HELOCs might see their lines of credit scores reduced or frozen significance they will not have the ability to take out added funds. Lenders do this to stop borrowers from overleveraging.

https://moz.com/community/q/user/urh0megarden

If this were to take place and you needed to market, the residential property would not make adequate to pay off your complete car loan balance. You 'd after that either deal with a short sale when you market your house at a steep discount as well as settle what you can (with your lending institution's authorization initially) or a foreclosure, in which the bank takes your residence and sells it off for you.